|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

No Bull's Five Spot | All Eyes on Argentina

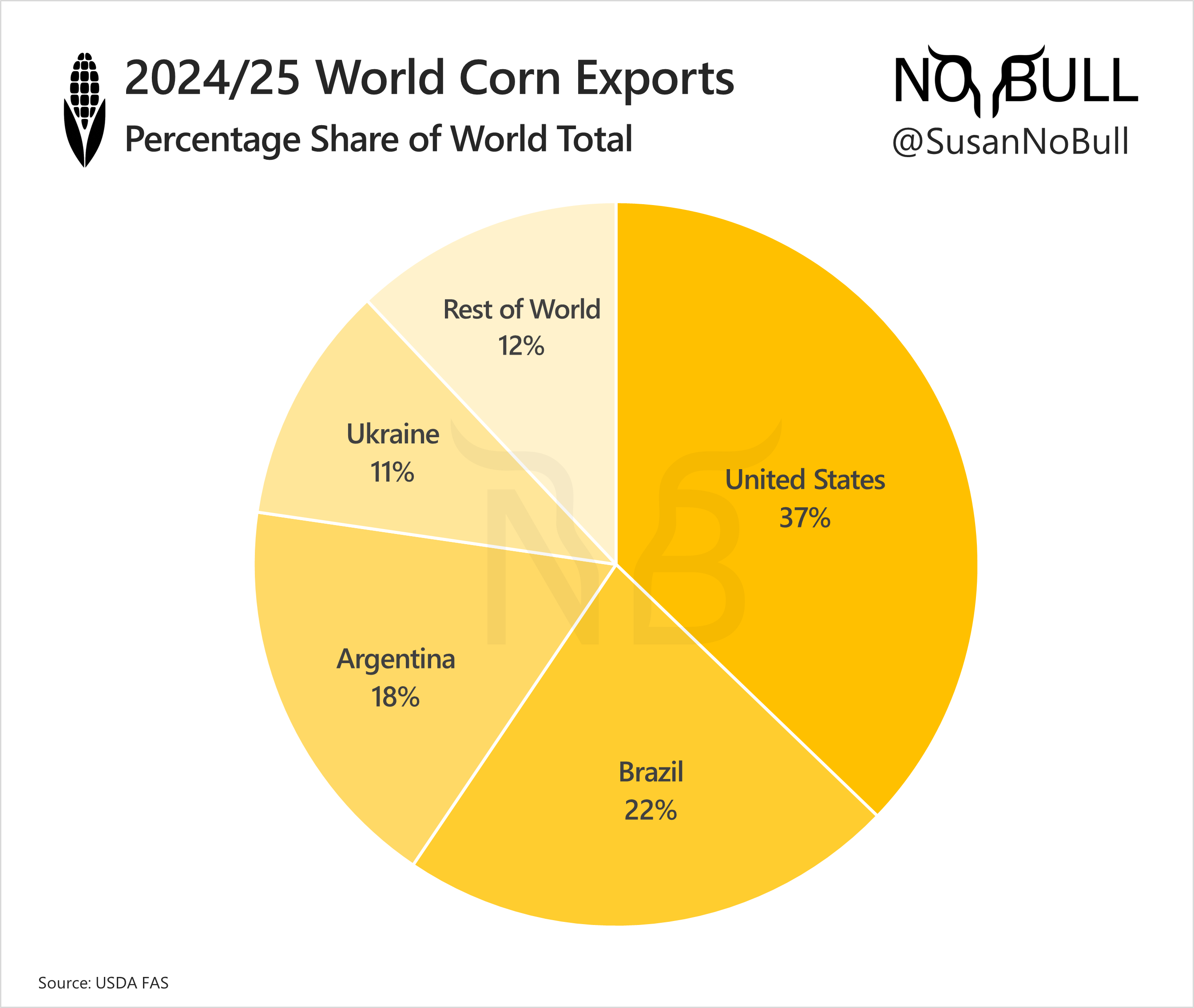

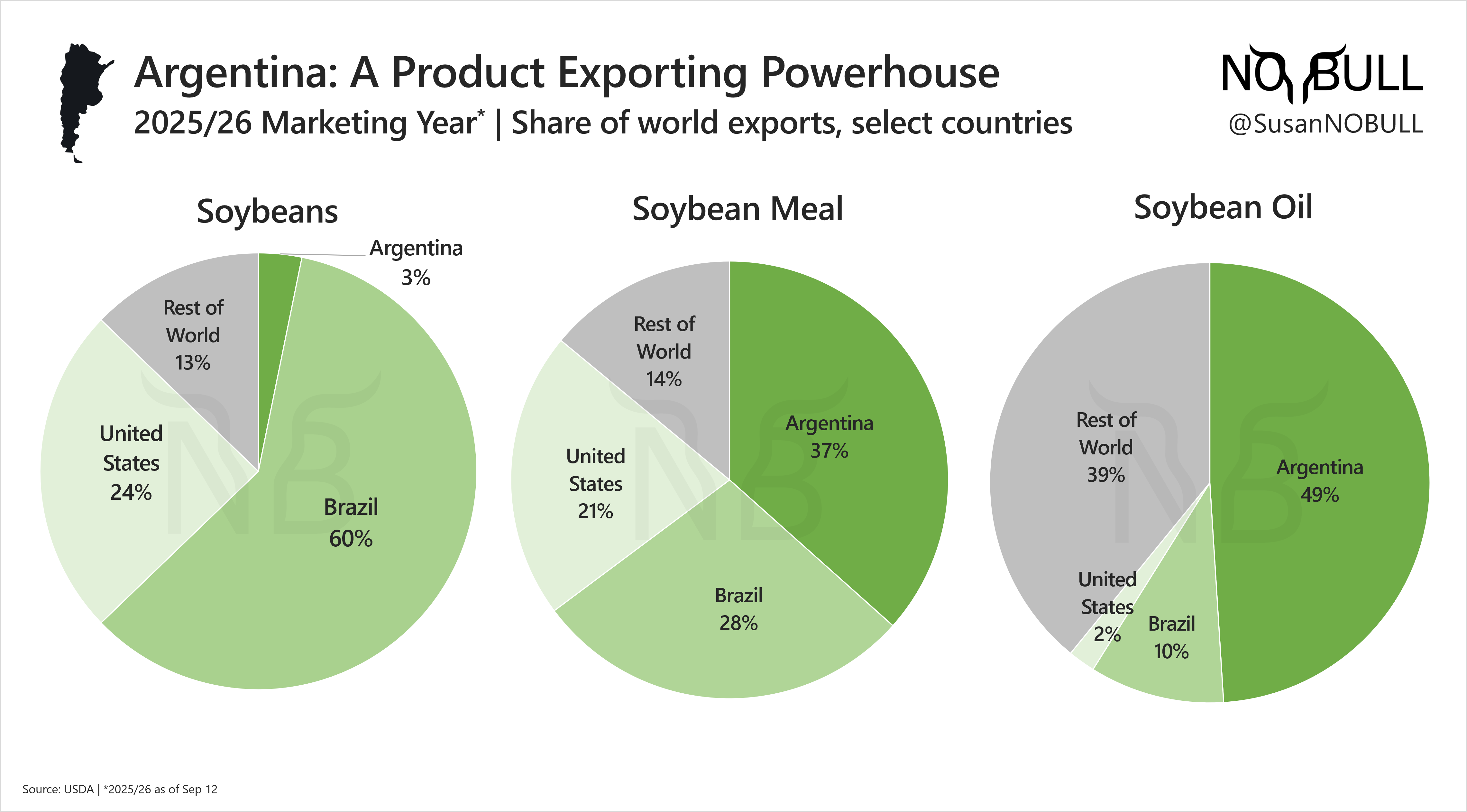

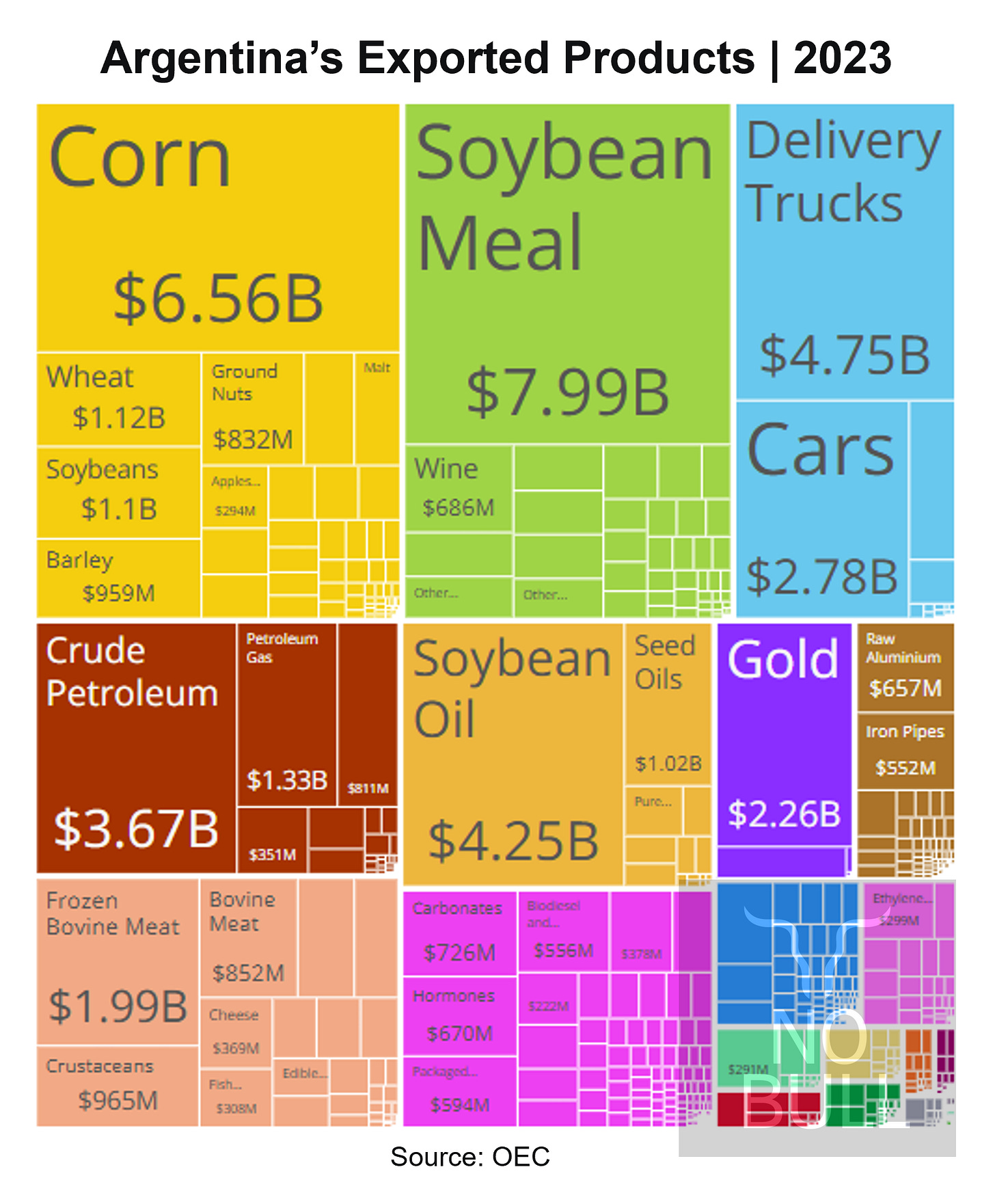

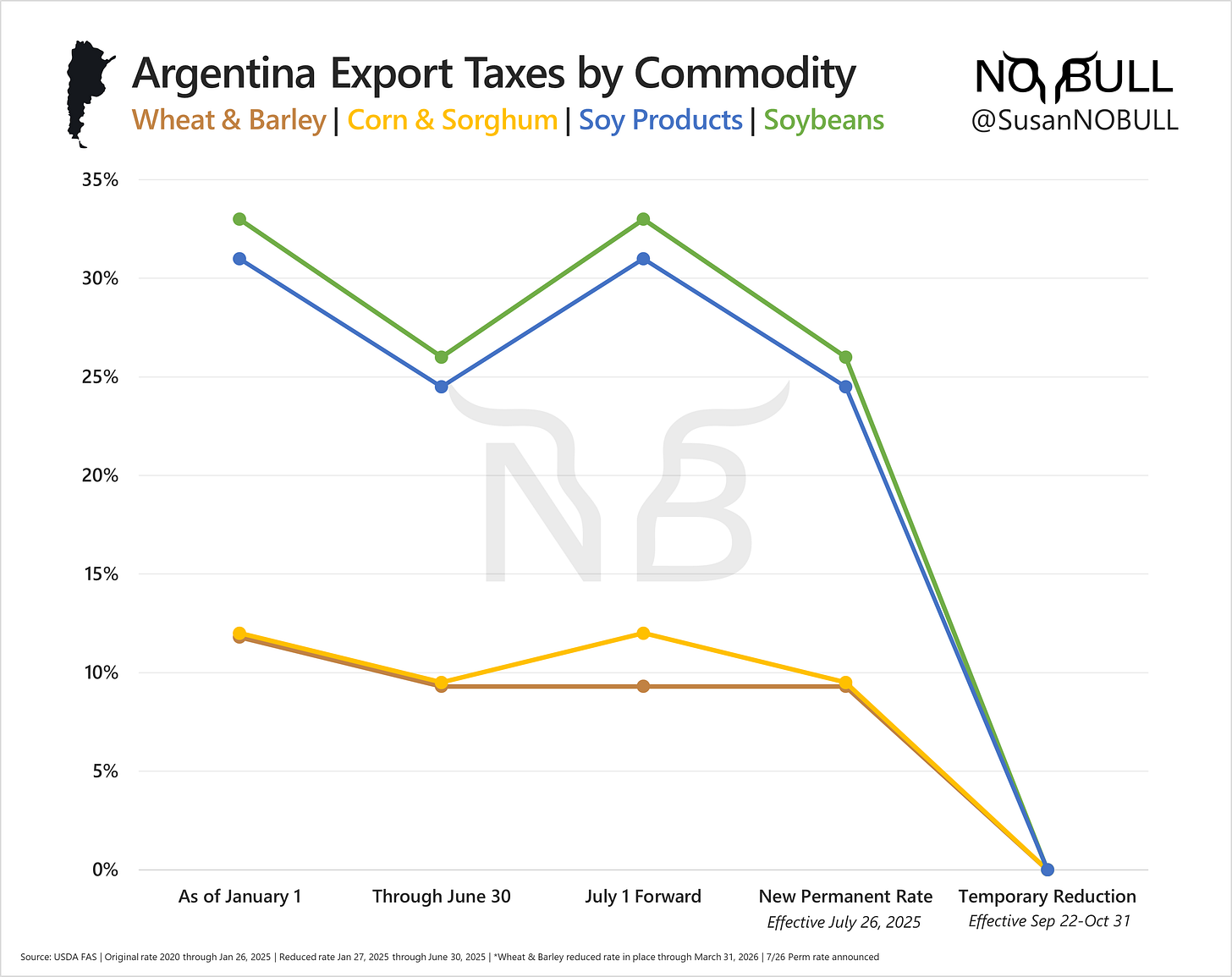

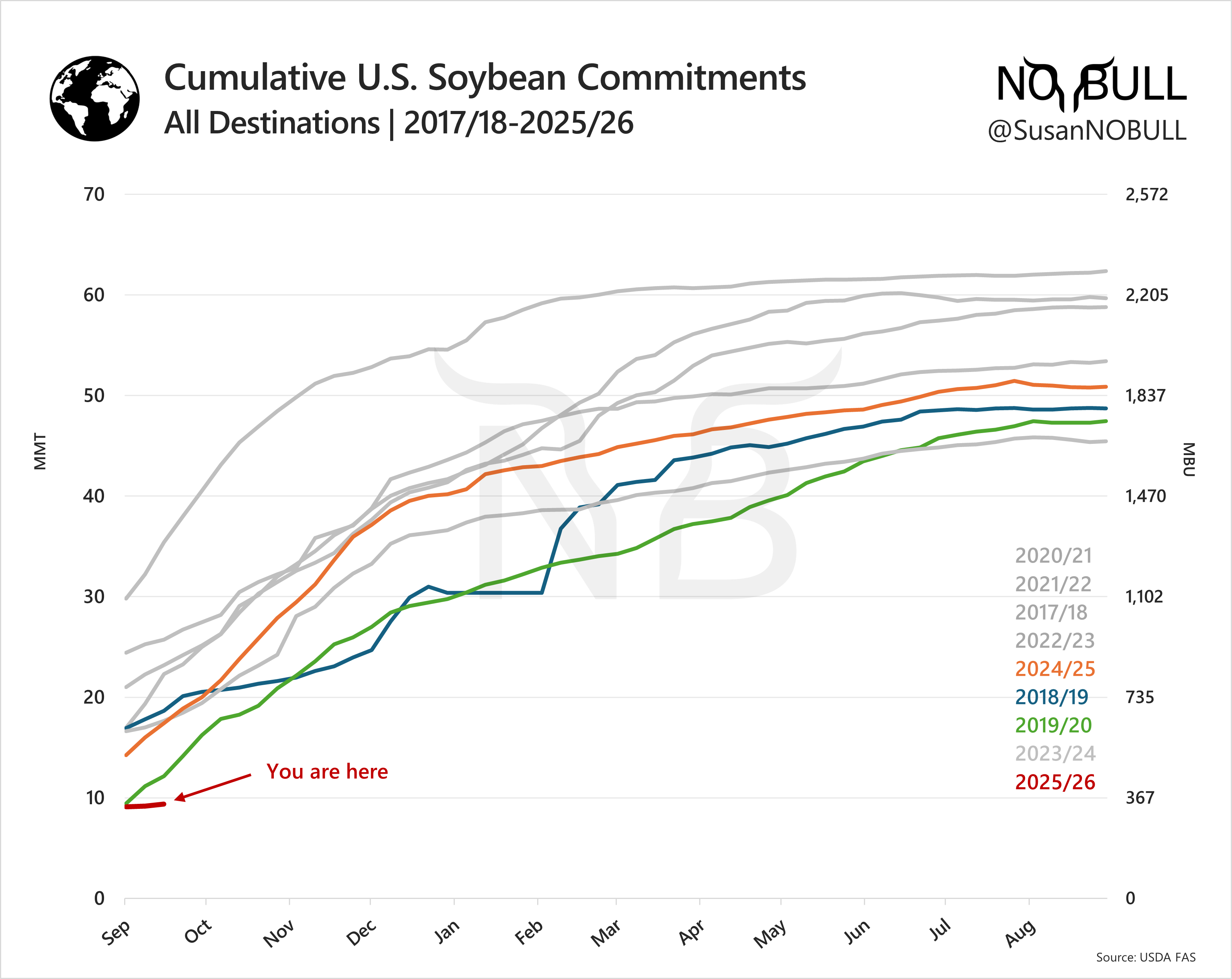

All eyes were on Argentina last week, where a temporary tax holiday has unleashed record sales, Chinese buying, and fresh pain for U.S. agriculture. Here's what you need to know: 5 | Small but mightyArgentina farms far fewer acres than the U.S. or Brazil, yet its impact on world agriculture is disproportionate. Roughly 70% of its 2-billion-bushel corn crop moves abroad each year, making it the third-largest corn exporter despite ranking only fifth in production. The same dynamic plays out in soy, where Argentina’s influence is rooted not in scale but in how critical its product exports are to global buyers.  4 | Exporting PowerhouseArgentina’s soy area is only half the size of U.S. acreage and a third of Brazil’s, yet its crush industry dominates global flows. Nearly one in every two tonnes of soyoil shipped worldwide comes from Argentina, and it has long been the top exporter of soybean meal. That dominance is now being challenged as U.S. and Brazilian crush expand, but Argentina’s role in oil and meal pricing remains unmatched.  3 | Exports as lifelineAgricultural commodities are the backbone of Argentina’s economy, accounting for more than half of its annual exports and serving as the country's largest source of hard currency. Argentina has long used agricultural export taxes (known as retenciones) as a major revenue source, first introduced in the early 20th century and repeatedly revived during times of financial crisis. While these levies are designed to generate much-needed dollars for the cash-strapped country, they have also produced unintended consequences - discouraging producer selling, curbing investment, and cementing their status as one of the most controversial pillars of Argentine policy.  2 | Tax holiday shockwaveArgentina’s surprise suspension of export levies unleashed a flood of sales. In just three days, 19.6 MMT of exports were registered — the equivalent of 900,000 semi-truck loads. The $7B quota was filled almost immediately, bringing the holiday to a premature end well before its October 31 deadline. Argentina’s move is a boon for both its producers and the world’s biggest buyer — China — with both benefiting from the cut of the soybean export levy from 26% to 0. Argentine bean premiums collapsed as a result and China was been right there to take full advantage of the blue light special, booking dozens of cargos of beans last week.  1 | Don’t cry for meIf you are unfamiliar, Evita — Argentina’s First Lady Eva Perón — was immortalized in the 1976 musical where she famously tells her people “don’t cry for me,” reassuring them she hadn’t abandoned them despite her rise to power. Today, U.S. agriculture doesn’t get the same reassurance. President Trump has once again left the American farmer in a precarious position with few options. Although he boasts about “winning” and claims to love the farmer, the only tangible result of his attack on China has been to hand market share first to Brazil — and now to Argentina. And to add insult to injury, this administration is proudly pledging support for Argentina, ready to provide a fiscal backstop if needed. Think about that: the U.S. taxpayer potentially bailing out Argentina, while Argentina actively cannibalizes U.S. soybean market share into China — a share that likely will not return. Farmers here don’t need another round of market-distorting “mailbox money” aid. They need business. The United States needs access to the world’s largest soybean importer. Until we make progress with Chinese relations, Argentina will keep selling beans at a discount — and U.S. producers will keep getting kicked while they’re down. The message may be “don’t cry for me, U.S. agriculture,” but for producers, the losses are painfully real. The clock is ticking and with China booking fall bushels and beyond with Argentina - our time is about to run out.  For the full version of this update, visit NoBullAg.Substack.com. Thanks!  This article contains syndicated content. We have not reviewed, approved, or endorsed the content, and may receive compensation for placement of the content on this site. For more information please view the Barchart Disclosure Policy here.

|

|

|